april 2016 service tax rate

Swachh Bharat Cess 05 wef. Effective Rates of Service Tax with SBC KKC 15 of single premium of charged from the Policy holder in case of single premium annuity policies wef.

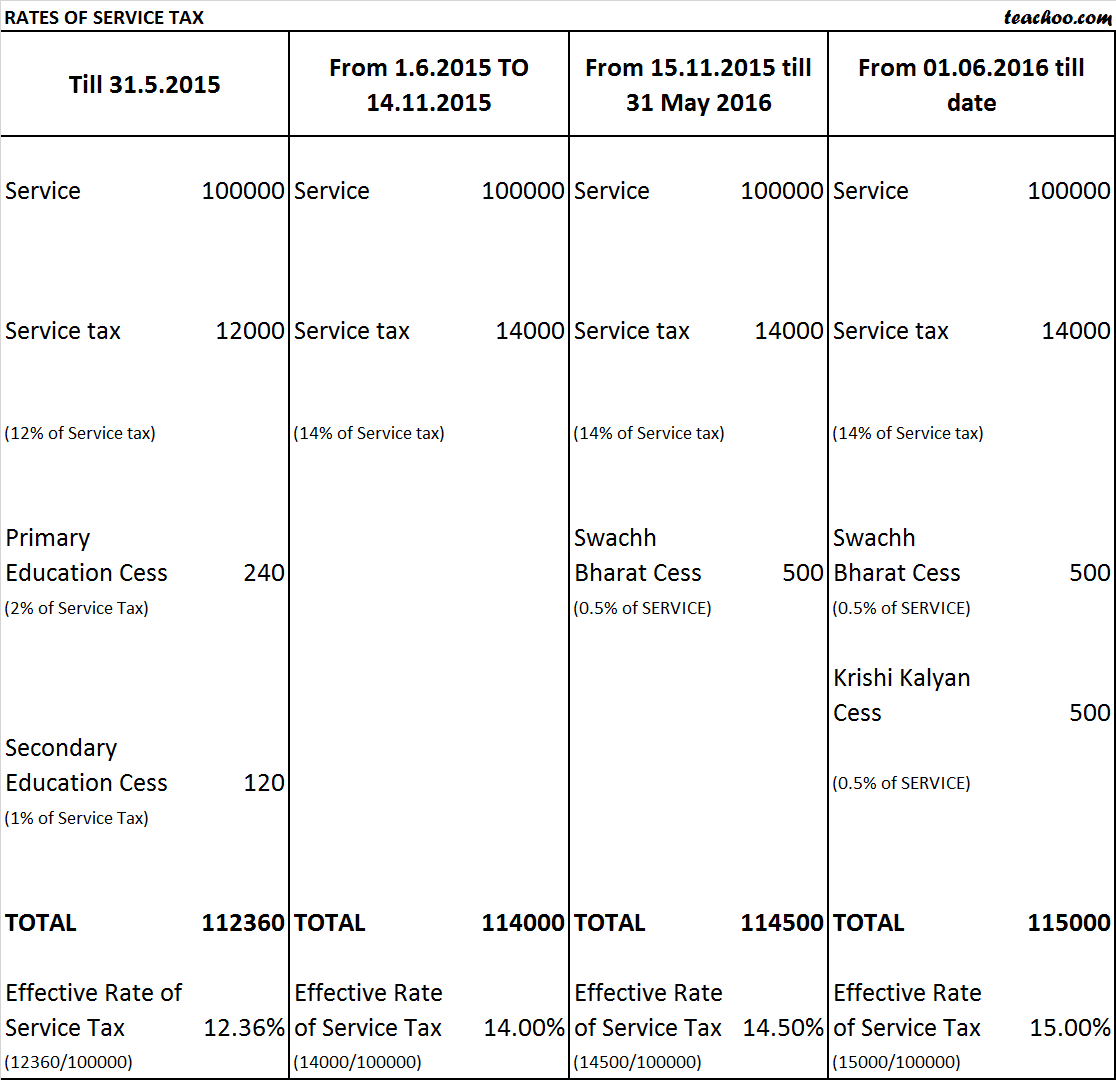

The service tax rate was increased from 1236 to 14 and the new rate subsumed a couple of cesses in the process.

. 8 rows April 2016-Sep 2016 April-May 145 July-Sep-15 Oct 2016-March 2017 Oct-March 15. 01-06-2016 from existing effective rate of 1450. Penal Rate in case of tax collected but not deposited to exchequer.

Thus abatement of 70 is presently available in respect of the said service. Cenvat credit on input input services and capital goods are not available. INR 1000 INR 100 per day from 31st day subject to a maximum amount of Rs 20000.

So all goods including household goods were covered. Any other changes in service tax rate w e f 1st April 2016. 28 of 2016 the effective rate of Service Tax wef.

However if assessee has collected service tax but did not deposit it with Government interest rate will be 24 Notification No. 242016-Service Tax dated 13 April 2016 The CENVAT Credit Rules have been amended to provide that CENVAT credit. The service tax rate may get changed by Budget 2016 from 145 to 16.

At present service tax is leviable on 30 of the value of service of transport of goods by vessel without Cenvat credit on inputs input services and capital goods. Service Tax Basic Rate -14. Changes in Service Tax by Union Budget 2016-17 Finance Act 2016 The above changes shall have impact on the levy of existing 1450 and revised ST rate 15 on the continuing works as well as on works completed but not billed.

20 of 2015 the Central Government hereby appoints the 1st day of April 2016 as the date on which the provisions of sub-section 1 of section 109 of the said Act shall come into effect. Service Tax Late Payment Interest Rate from 14052016 Interest payable for delayed payment of Service Tax is 15. 1875 of gross amount of premium charged from Policy holder in subsequent years.

Any other changes in service tax rate w e f 1st April 2016. 132016-ST dated 1-3-2016 effective from 14th May 2016. After levy of KKC.

Description of service provided Existing Taxable Value Taxable value after amended Abatement 2 Transportation of goods by rail by Indian Railways 30 without Cenvat credit 30 with input service Cenvat credit 2A Transportation of goods in containers by rail by other than Indian Railways 30 without Cenvat credit 40 with input service Cenvat credit 3. New Service Tax Chart with Service Tax Rate of 15. 18 rows 600.

01-06-2016 is increased from 1450 to 15 14 ST 050 Swachh Bharat Cess 050 Krishi Kalyan Cess by way of introducing Krishi Kalyan Cess 050 on value of taxable services. The calculation of the amount that can be levied is done as a percentage of the charges paid or received for the receipt or provision of services. Service Tax has been replaced by the Goods and Services Tax GST starting 1 July 2017.

16 rows Rate of Service tax would eventually increases to 15 wef. 2 A tour other than 1 above. The 15 includes 05 Krishi Kalyan Cess and 05 Swach Bharat Cess.

From 14052016 Interest payable for delayed payment of Service Tax is 15. From 142016 service tax is leviable on 30 on amount charged for service of transport of passengers by rail without availability of cenvat credit of inputs and capital goods. Effective 1 April 2016 VAT rate on sale of Aviation spirit aviation turbine fuel and A V Gas has been increased from 125 to 18.

Accordingly the rate of ST shall be 15 wef. However in order to facilitate the the Tour Operators the Government has permitted the CENVAT Credit on Input Services used for providing the Taxable Services. 42 1430 435 14530 45 1530 Effective from 01042016 a uniform abatement at the rate of 70 is prescribed for services of construction of complex building civil structure or a part thereof subject to fulfillment of the existing conditions.

You may also like to read Chapter V of Finance Act 1994. If a new levy is introduced like Krishi Kalyan Cess or a service taxed for first time then Rule 5 is to be referred. The rate of Service Tax was.

New Service Tax Rate effective from 01-06-2016 After enactment of the Finance Act 2016 No. However if assessee has collected service tax but did not deposit it with Government interest rate will be 24 Notification No. Provided also that where the gross amount of service tax payable is nil the Central Excise officer may on being satisfied that there is sufficient reason for not filing the return reduce or waive the penalty.

132016-ST dated 1-3-2016 effective from 14th May 2016. Service Tax Interest Rate. For the tax payers with value of taxable service less than 60 lakh rupees in PFY interest rate for delayed payment will be 12.

Abatement will continue with the same level with cenvat credit of input services for the said service. Service tax rate increased from 145 to 15 increase by way of levying Krishi Kalyan Cess at 05. Earlier this is applicable for Services of goods transport agency in relation to transportation of goods.

For the scenario till 31032016. 01-04-2016 375 of gross amount of premium charged from Policy holder in 1st year. From the 1st of June 2016 service tax is levied at 15 of the value of taxable services under Section 66 of the Service Tax Act.

The Said change will be effective from 1st June 2016. Cenvat credit of input services are now available. The Ministry of Finance increased the Service Tax rate in May 2015 and it was effective from June 2015.

Rate of Service Tax changed to 9 NEW RATE from earlier 45 OLD RATE Abatement reduced from 70 to 40. In exercise of the powers conferred by section 109 of the Finance Act 2015 No. Cenvat Credit of Input Input Service Capital Goods used for providing the said service is not availed.

What Is The Rate Of Service Tax For 2015 16 And 2016 17

Tds Rate Chart Fy 19 20 Ay 20 21 Simple Tax India Tax Deducted At Source Chart Tax Deductions

Rescinding Of Notifications Under Certain Sections Of Mvat Http Taxguru In Goods And Service Tax Resc Goods And Services Goods And Service Tax Indirect Tax

Pin By Pooja Bhatt On Gst India Goods And Services Tax Goods And Services Goods And Service Tax Indirect Tax

Goods And Services Tax Economics Lessons Business And Economics Economics

Where Do Your Taxes Really Go Infographic Us On Behance Infographic Tax Told You So

Understanding Your Tax Forms 2016 1098 Mortgage Interest Statement Mortgage Interest Student Loan Interest Credit Card Services

E Invoicing Mandatory From 1 April 2021 Turnover Above 50 Crore Are You Ready Are You Ready Invoicing Language

Ers Tiers 3 And 4 Benefits Tiers Retirement Pension Fund

Pin By Sakshi On Nsc Saving National Certificate

Where Do Your Taxes Really Go Infographic Us On Behance Infographic Tax Told You So

Pin On Inventory Management Software India

Online Tax Preparation Software Review H R Block Turbotax Taxact Tax Preparation Diy Taxes Income Tax Return

F Y 2016 17 Due Dates Of Service Tax Tds Tcs Central Exxcise Cst Vat Pt Esic Pf Accounting Taxation Tax Payment Tax Due Date

Rental Agreement For Flat Money Deposit And Rental Agreement Service Nobroker In Provided By You Being A Landlord Lease Agreement Agreement

Rental Agreement For Flat Money Deposit And Rental Agreement Service Nobroker In Provided By You Being A Landlord Lease Agreement Agreement

2016 Marketing Planning Calendar Vandenberg Web Creative Marketing Planning Calendar Marketing Strategy Social Media Social Media Marketing

Pin By Lisapetbulous On Electric Scooter Business Singapore Registration Number